Welcome to the April edition of our Global Logistics Update. As we head into the second quarter of the year, the logistics industry continues to evolve with shifting supply chain dynamics and certainly new challenges in global trade. Stay ahead of the curve with our port analysis, industry news, and practical insights to help you optimize your logistics operations.

South African Ports

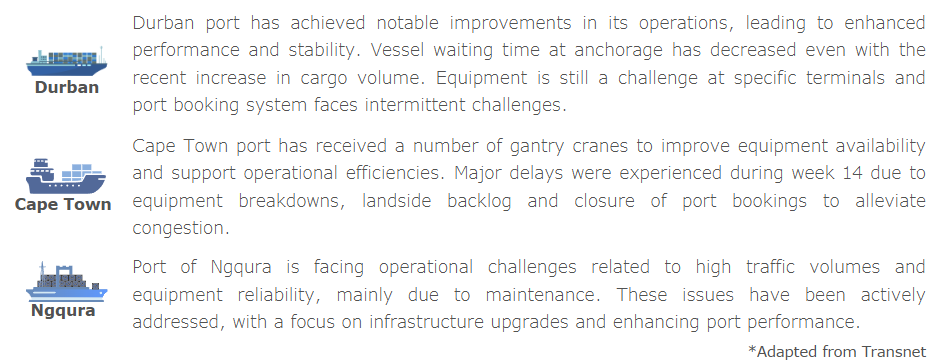

South Africa’s ports play a critical role in the country’s economic growth, serving as key gateways for trade and connecting Africa to global markets. Managed by Transnet National Ports Authority, these ports have evolved significantly over the years, adapting to trade dynamics, and supporting a variety of cargo types, including bulk commodities, containers, liquid fuels, and automotive products. The primary ports include Durban, Cape Town, Richards Bay, Ngqura, Port Elizabeth, Port of East London and Saldanha Bay, each with varying degrees of challenges and advancements. We expand weekly on our three main ports below:

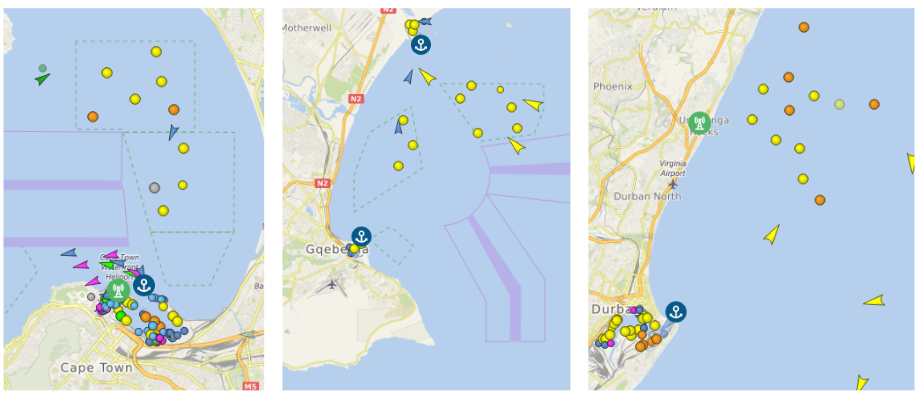

We highlight in these images vessels currently at anchorage pending berth at our three main ports. Port congestion and delays have been reported with Durban at 5 days, Cape Town at 8 days and Coega at 2 days on average.

South Africa’s key ports, particularly Durban and Cape Town, have been facing increasing congestion and operational challenges, impacting efficiency and supply chain reliability with significant impact on the global shipping landscape. Durban port experienced high cargo volumes in the last quarter with improvements on cargo handling. Several strategic measures have been implemented to improve efficiency going forward and reduce delays in vessels berthing. Cape Town port experienced multiple operational disruptions due to equipment failures and adverse weather conditions, particularly strong winds. These conditions led to significant delays, schedule disruptions and, in some instances, the suspension of port operations. Efforts to improve overall efficiency is underway, as published by Transnet National Ports Authority.

Transnet Port terminals unveil plans to enhance Cape Town’s Port efficiency

Transnet Port Terminals (TPT) is advancing a development agenda aimed at enhancing operational efficiency at the Cape Town Container Terminal.

Transport union declares wage dispute with Transnet

The United National Transport Union (Untu) has declared a dispute of mutual interest with the Transnet Bargaining Council after reaching a deadlock in the recent 2025/6 wage negotiations with the ports operator.

https://www.freightnews.co.za/article/transport-union-declares-wage-dispute-transnet

Tariffs have essentially nullified Agoa – Tau

The Minister of Trade, Industry and Competition says having reciprocal tariffs on goods imported from the US would be a race to the bottom.

https://www.moneyweb.co.za/news/economy/tariffs-have-essentially-nullified-agoa-tau

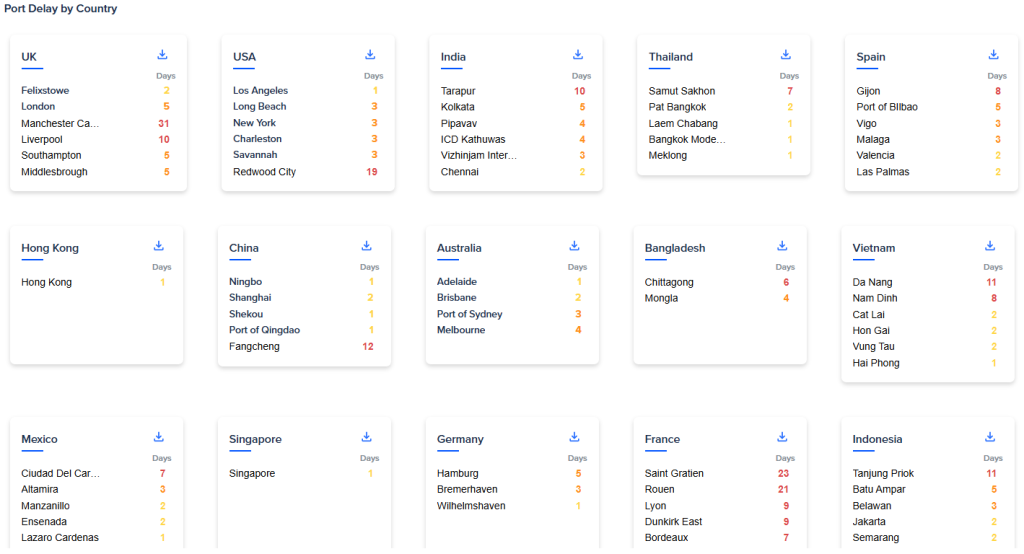

Global Ports

Global ports are the linchpins of international trade, serving as the critical interface between maritime transport and land-based supply chains. Their efficient operation is paramount to the smooth flow of goods, impacting everything from consumer product availability to global economic stability. Global port congestion is a complex issue, and we therefore only review basic routing, infrastructure demands and berthing delays.

PORT UPDATES:

Ports not mentioned under each region, experience minor berthing delays of less than 2 days.

AFRICA & INDIAN OCEAN ISLANDS

Angola/Ivory Coast/Tanzania– Berthing delays of 6 days experienced at main ports

Mauritius– Berthing delays of 2 days experienced at Port Louis

NORTH AMERICA

Canada

Toronto/Vancouver – Berthing delays of 6 days experienced at main ports.

Montreal- Berthing delays of 1 day experienced at this port with winter restrictions lifted.

USA

New York/Norfolk/Miami/Houston/Charleston/Oakland – Berthing delays of 3-5 days experienced at main ports

Savannah/ Seattle – Berthing delays of 5 days experienced at main ports

*Vessel schedule amendments are occurring frequently and well as vessel rotations, some at last minute.

The Ports of New York and New Jersey experienced significant congestion attributed to high import volumes, holiday scheduling, and adverse weather conditions. These factors impeded the timely return of empty containers

LATIN AMERICA

Brazil/Argentina/Mexico – Berthing delays of 3 days on average experienced at main ports.

In Brazil, indigenous protests, and deteriorating road conditions severely disrupted soybean exports via the Miritituba river port in the Amazon. Road blockades persisted for two weeks, halting daily shipments and causing significant operational challenges.

NORTH WEST CONTINENT, UNITED KINGDOM, MEDITERRANEAN

Belgium/Turkey/Spain/Netherlands – Berthing delays of 3-5 days on average experienced at main ports

France/Germany/Italy – Berthing delays of 6 days experienced at main ports

UK – Berthing delays of 2 days experienced at London Gateway Port.

Northern European ports faced critical congestion, with significant vessel waiting times reported. For instance, Antwerp had 31 vessels at anchor, and Gibraltar (Algeciras/Tangier) had 36 vessels waiting to berth recently.

INDIAN SUB-CONTINENT & MIDDLE EAST

India/UAE/Sri Lanka – Berthing delays of 3 days experienced at main ports with increase volumes in Mundra and Nhava Sheva.

APAC (Including Oceania)

Ningbo/Qingdao/Korea/Shanghai – Berthing delays of 4-6 days experienced at main ports

Malaysia – Berthing delays of 2 days at Port Kelang

Transshipment port congestion remained a critical issue, with delays of approximately 10-14 days at major ports such as Busan, Shanghai, Ningbo, and Singapore. These delays were primarily due to fog closures and the arrival of delayed vessels, leading to vessel bunching. Carriers also implemented service adjustments, including omitting certain ports and rerouting cargo where ports were congested.

New carrier alliances launch with record schedule reliability

Sea intelligent published its monthly schedule reliability figures, including data showing how sailings under the Gemini Cooperation performed in the first month of Maersk and Hapag-Lloyd’s new operational collaboration.

February 2025 saw the launch of two new carrier alliances, Gemini Cooperation and Premier Alliance, while 2M and THE Alliance will be phased out in the coming months. Ocean Alliance will continue to operate as is. While MSC is not an alliance, the fact that they are going solo on East/West trades, and the vastness of their operated East/West network, means that they cannot be overlooked in an alliance context.

Gemini Cooperation recorded 94.0% schedule reliability in origin ports in February 2025, followed by MSC at 79.6%, and Premier Alliance at 60.4%. Ocean Alliance recorded 54.1% schedule reliability, while the outgoing THE Alliance and 2M scored 45.3% and 44.2%, respectively. It is important to stress that the new alliances are just in the beginning phase of their network roll-out, and they will only be fully rolled out in July 2025, and only then will it be possible to truly evaluate their performance. It is nevertheless an interesting data point, to see how they have performed on the initial origin arrivals.

Sustainability, digitalisation, and regulation are reshaping maritime logistics

Beyond environmental policies, the industry is facing digitalisation challenges, cybersecurity threats and labour shortages.

Shipping and scenario planning

How can you plan for the future when the present is so uncertain? Uncertain, complex, and a rapidly changing environment: this seems to describe perfectly our brave new world.

https://splash247.com/shipping-and-scenario-planning/

Freight News

We understand the importance of staying up to date with the latest trends, challenges, and advancements in our industry and we wish to highlight just a few articles which you might find of interest.

Everything You Need to Know About Trump’s New Tariff Plan: Every Country, Every Rate

https://www.supplychain247.com/article/donald-trump-reciprocal-tariff-details

Container freight rates for Chinese exports plunge 28%

https://www.freightnews.co.za/article/container-freight-rates-chinese-exports-plunge-28

Uncertain Waters: Securing Ocean Freight Rates

https://metro.global/news/uncertain-waters-securing-ocean-freight-rates/

Trade imbalances and tariffs – Trump has it all wrong

https://www.freightnews.co.za/article/trade-imbalances-and-tariffs-trump-has-it-all-wrong

Trump’s ‘Liberation Day’ Tariffs Spark Global Shipping Industry Concerns

https://gcaptain.com/trumps-liberation-day-tariffs-spark-global-shipping-industry-concerns/

Good news on border delays – Road Freight Association

https://www.freightnews.co.za/article/good-news-border-delays-road-freight-association

Transnet warns union against industrial action

https://www.freightnews.co.za/article/transnet-warns-union-against-industrial-action

Middle East and Asia should be primary focus for SA

https://www.freightnews.co.za/article/middle-east-and-asia-should-be-primary-focus-sa

Sources & References

Seatrade Maritime / Loadstar / Freight News / GoComet / Maersk / Openpr / Transnet / WeFreight / MSC / AfricaPorts / Container Statistics+News / Flexport / SACO / Hellenic Shipping / Worldcargonews/ Maritime Executive / GCaptain/ Linerlytica / Sea Intelligence / Nan news / Freight Waves / Xeneta.