As we start a new year, supply chain leaders and trade professionals are reflecting on the challenges and lessons of 2025 while preparing for the year ahead. The past year closed with continued pressure on global trade, driven by fluctuating freight demand, port congestion and ongoing geopolitical uncertainty, all of which impacted shipping costs and reliability. Many of these dynamics are expected to continue into 2026. This update reviews key developments from the global logistics landscape and highlights the shipping and trade trends shippers should be mindful of in the months ahead.

South African Trade

South Africa’s ports remain at the heart of the country’s trade network, keeping everything moving from everyday consumer goods to machinery, fuel and critical industrial inputs. Looking back at 2025, port performance showed encouraging improvement overall, with local terminals handling higher container volumes than in recent years. This was largely driven by the introduction of new equipment, steady productivity gains, and more consistent weekly vessel activity across key ports such as Durban, Cape Town and Gqeberha. That said, 2025 wasn’t smooth sailing all the way. Weather related disruptions, intermittent equipment issues, and uneven performance between terminals continue to create delays at times, with pockets of congestion still emerging during peak seasons. For importers and exporters, this reinforces the importance of forward planning and real-time supply chain visibility to help minimise surprises and keep cargo moving as efficiently as possible.

Key Improvements in 2025

- Durban performance has become more predictable with better crane deployment and fewer breakdowns compared with a year ago

- Equipment shortages, congestion, and weather disruptions remain the main constraints on port capacity and while conditions are not as chaotic as a year ago, delays and unpredictability are still real risks.

- Transnet and other stakeholders are rolling out targeted upgrades and new equipment, but benefits are gradual and sometimes offset by external factors like weather and shipping schedules.

We expand below on the most recent field challenges at our key ports namely Durban, Cape Town and Ngqura:

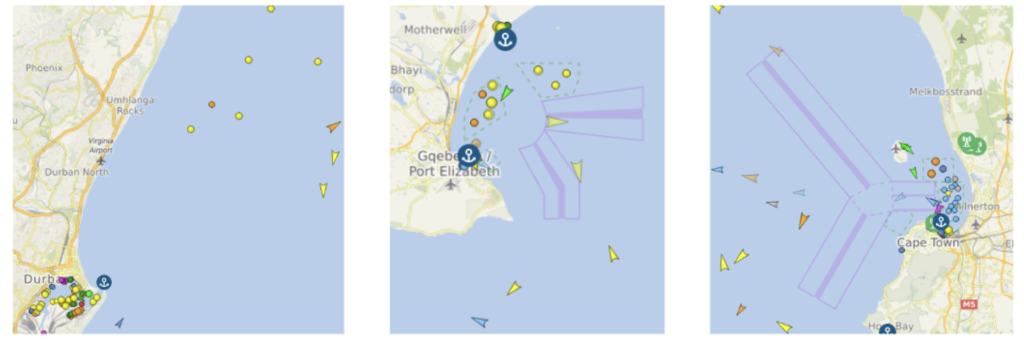

The following images illustrate vessels currently at anchorage awaiting berth at South Africa’s three key ports:

Road / Rail Update:

Road freight through South Africa’s land borders was busy over December and into early January 2026, with festive-season traffic and strong regional trade putting pressure on key crossings. Borders such as Beitbridge and Lebombo saw periods of congestion, although extended operating hours and extra staffing helped clear backlogs at peak times. System interruptions, increased enforcement, and limited infrastructure at some border posts continue to cause delays. Overall, road freight is moving, but planning ahead and allowing extra time remains important as the year gets underway.

Fuel price reprieve for road freight sector

Warning issued over expected unrest in Copperbelt

Air Freight Update:

Air cargo volumes through South Africa’s main gateways picked up sharply, with international airfreight up around 16% week on week and both inbound and outbound shipments increasing. While this reflects a strong recent upswing, clients should remain aware of potential last minute space constraints, rate fluctuations and schedule uncertainties.

Airfreight index climbs 6% as peak season drives surge

Please review below articles for key updates in South Africa:

2025 – A year of turning tides in SA’s freight landscape

Transnet, ICTSI ink 25-year Durban Pier 2 deal, industry calls for transparency

Logistics network ends year on firmer footing

MSC adjusts service from Gqeberha to Cape Town

South African trade has shown resilience over the past year with improvements in port operations and steady growth in import and export volumes. Challenges persist but ongoing investments and operational upgrades offer hope. As 2026 begins, there is optimism that trade flows will become more reliable, supporting smoother movement of goods in and out of the country.

Global Trade

PORT UPDATES:

Unlisted ports per region are experiencing minimal delays (≤ 2 days), measured as monthly averages from weekly performance.

AFRICA & INDIAN OCEAN ISLANDS

Vessel delays, schedule amendments and extended transit times continue to be experienced. Terminal performance in S.A. has improved overall, equipment and booking challenges however remain a concern.

Angola/Nigeria – Berthing delays of 3-4 days experienced at main ports

Ghana – No major berthing delays at Tema port, terminal is however facing slow operations and productivity due to crane outages

Namibia – Berthing delays of 3 days experienced at Walvis Bay

Ivory Coast– Berthing delays of 2 days at Abidjan port with slower operations than normal

Kenya – Berthing delays of 4-5 days experienced at Mombasa port

Tanzania– Berthing delays of 5-6 days at Dar Es Salaam

Mozambique– Berthing delays of 3 days experienced at Maputo and 19 days at Beira port

Mauritius– Berthing delays of 3 days experienced at Port Louis

Reunion – Berthing delays of 4 days experienced at port of Reunion

NORTH AMERICA

Canada

Toronto/ Montreal/ Vancouver – Berthing delays of 2-4 days experienced at main ports

Ongoing adverse weather conditions are experienced, resulting in vessel delays and dwell time up to 4 days

USA

New York/New Jersey/Long Beach – Berthing delays of 2-3 days experienced at these terminals.

Savannah/Charleston – Berthing delays of 3 days experienced at main terminals.

LATIN AMERICA

Brazil – Berthing delays of 3 days experienced at Paranaguá. Containers destined for S.A. are no longer loaded out of Santos due to a change in vessel rotation.

Mexico – Berthing delays of 3 days experienced at main ports with main delays at Altamira port

NORTH WEST CONTINENT, UNITED KINGDOM, MEDITERRANEAN

Belgium/France/Germany – Berthing delays of 3-5 days experienced at main ports.

Netherlands/Spain/Italy – Berthing delays of 2 days experienced at main ports

Spain – Berthing delays of 3 days experienced at Barcelona port

UK – Berthing delays of 2 days experienced at London Gateway Port.

*Main transhipment hubs have seen improvement; schedules however remain erratic and port rotations anticipated

INDIAN SUB-CONTINENT & MIDDLE EAST

India/Sri Lanka/UAE – Berthing delays of 2 days experienced at main ports

Israel – Ports operate as usual

APAC (Including Oceania)

Qingdao/Tianjin – Berthing delay of 3-4 days experienced at these ports

Xiamen – Berthing delays of 14 days experienced at this port

Taiwan – Berthing delays of 2 days experienced at Kaohsiung

Korea – Berthing delays of 5 days experienced at Busan port due to vessel bunching

Singapore– Berthing delays are minimal, vessel bunching and schedule rotations is still a challenge

Chinese New Year starts on the 17th February and lasts up to 16 days. Only the first 7 days are considered a public holiday. Please expect shipping delays as service providers will be closed over this time.

Golden Week holidays will be from 29th April to 6th May 2026. Please expect delays over this time.

Please review below articles for key Global news:

Future-ready logistics: five shifts to watch in 2026

Global powers vie for commodity influence in Africa

Container volumes break through TEU milestone

Sustainability & Green Shipping

Environmental imperatives continue to shape long-term planning, with new fuel initiatives and decarbonisation frameworks emerging as differentiators for major carriers looking ahead to 2030 and beyond.

Hapag-Lloyd and NCL to power container ships with e-fuels from 2027

Cleantech Producers Call on EU – Boost Support for Green Shipping

Sustainability in Maritime: Green Shipping and Decarbonization

Logistics Market Outlook – What 2025 means for 2026

(read full article Here)

What happened globally in 2025 will still influence logistics in 2026. While some pressure points are easing, the market remains uneven. For South Africa, this means freight availability is improving, but planning and flexibility remain critical, especially around ocean freight.

Ocean Freight:

· Global trade volumes are still growing, but not evenly across all regions.

· The US and China drove much of the volatility in 2025, but their issues indirectly affect SA through carrier network decisions and pricing.

· For South African importers and exporters, seasonality should look more “normal” in 2026, unlike the stop-start patterns seen in recent years.

· Shipping lines added many new vessels globally into 2025. There are now more ships than cargo on many trade lanes.

· Even with disruptions like the Red Sea diversions, the market is oversupplied. This oversupply helps keep ocean freight rates under pressure, which is positive for SA importers.

· However, South Africa remains a long-haul, secondary trade, so rate reductions may lag behind Asia–Europe or Asia–US lanes.

· Carriers may add blank sailings or reduce frequency to manage capacity, which can still affect reliability.

· Carriers have begun cautious returns to pre-diversion Suez routes, which could initially cause congestion and higher rates at European hubs

Air Freight:

· Global air cargo remained surprisingly strong in 2025, driven by e-commerce, movement of high-value goods and urgent orders when ocean freight was unreliable. Growth is expected to continue into 2026, but at a slower more stable pace.

· Airlines have become more flexible, moving aircraft between routes where demand is strongest. Rates stayed relatively stable in 2025 and followed normal seasonal patterns.

· Opportunities may open as airlines redeploy capacity to alternative trade lanes, including Africa–Europe and Africa–Middle East routes

Rail:

· The global rail freight market is expected to grow steadily in 2026 and beyond, with consistent increases in volumes and revenues as countries invest in rail infrastructure and intermodal connections.

· Asia-Europe freight rail (e.g., China-Europe routes) continues to grow, moving millions of containers annually and expanding the number of cities and partner countries served.

· China has been increasing its rail freight network and global connections, which reduces logistics costs and improves transit reliability for long-distance land-linked trade.

· In the Middle East and Africa, rail freight accounts for around 9–10% of the global market, with major corridors being expanded.

· South Africa’s national freight rail operator Transnet is investing heavily (over R127 billion) to modernise rail lines and improve capacity, this should reduce delays and better support export of key commodities

· Rail freight is becoming a larger piece of the global logistics puzzle. It’s not a replacement for ocean or air freight but adds capacity and choice for medium distance and intercontinental trade flows. (Rail Freight Market)

For South Africa, 2026 looks more stable than the past few years, but certainly not risk-free. Freight costs should be easier to manage, especially at sea, while air freight remains a reliable though premium option. The key focus should be forward planning, flexibility and realistic transit expectations, rather than chasing the cheapest rate alone.

In today’s shifting freight landscape, supply chain visibility and cost control are more important than ever. At SCT Supply Chain Solutions, we anticipated these changes early, including the industry-wide increase in software costs linked to global platforms such as CargoWise, which many forwarders now pass on to shippers. In 2024, SCT made a strategic decision to change software providers so that our customers are not impacted by these ongoing increases, making us one of the few forwarders who do not bill clients for this service. More recently, we launched our online customer portal, providing real-time shipment tracking with access to documents and key performance data in one place. With transparency and integrity at the core of how we operate, SCT offers more than clearing and forwarding — we help businesses manage logistics with confidence, control and real value.

Freight News

We understand the importance of staying up to date with the latest trends, challenges, and advancements in our industry and we wish to highlight just a few articles which you might find of interest. Kindly ctrl + click on each topic to read further:

Historic day for SA as port partners seal deal

Air carrier sets ambitious cargo growth targets for 2026

China’s first vacuum auto-mooring system goes live at Qingdao port

An anti-dumping investigation of flat-rolled products of iron or non-alloy steel:

COSCO will acquire control of the German logistics company Zippel

A Maersk Line ship has returned to transit the Suez Canal

JPNA Initiates Stakeholders Dialogue – Port Development in India

MSC Recognized as World’s Largest Container Line Surpassing Maersk

Sources & References

Seatrade Maritime / Loadstar / Freight News / GoComet / Maersk / Openpr / Transnet / WeFreight / MSC / AfricaPorts / Container Statistics+News / Flexport / Phaata /SACO / Hellenic Shipping / Worldcargonews/ Maritime Executive / GCaptain/ Linerlytica / Sea Intelligence / Splash247 / Freight Waves / Xeneta / JOC / DHL / African Mining / Ean Network / Hapag Lloyd / Deloitte.